Uncover Liquidity with Intraday

Iceberg Order Detection

Let Data Drive Your Decisions

Iceberg orders represent institutional investor sentiment

Our differentiated Liquidity Lamp Summary - Intraday (LLSi) dataset uncovers these order types and alerts you to new alpha-generating opportunities. By adding the LLSi dataset to a baseline mean reversion strategy our model...

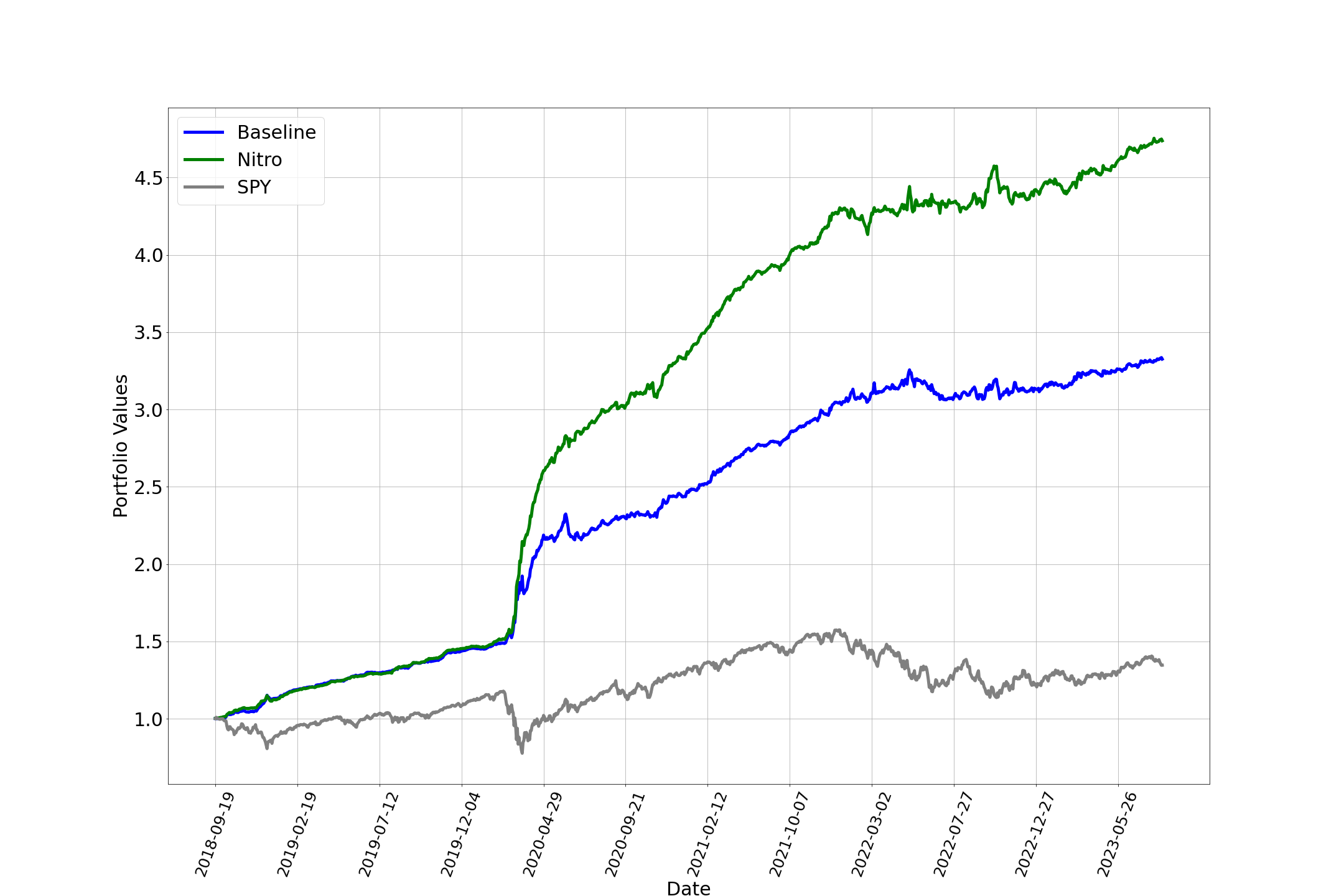

- Outperformed the baseline by 10.5% and the S&P 500 (SPY) by 31.8%, respectfully in the out-of-sample testing.

- Proved resilient to volatility with overall lower maximum drawdowns compared to both the baseline model and the SPY.

LLSi can help manage market volatility, reduce risk, and optimize your execution strategies – so you can better capture alpha.

Read our whitepaper to find out more about how the LLSi dataset can enhance your trading strategies.

Figure 1: Graphical representation of the Baseline and Experimental Nitro model performance compared to the SPY from 2018/09/19 to 2023/08/18

Access the Whitepaper

Explore Exegy’s Market Data Products:

Market Data as a Service – Axiom

Built for ease of use, stability, and consistent performance, Axiom is Exegy’s preferred solution for cost conscious firms, retail brokers, and expanding businesses that need fast access to global markets.

The Exegy Ticker Plant

With an unparalleled combination of speed, capacity, features, and bundled services, the Exegy Ticker Plant is the premier solution for the largest buy-side and sell-side firms for mission-critical, low-latency market data processing.